Conversion of money is very important for world economies. There is a need of a market for this type of trade. In this article, you can find some details about forex trading and how to make a trade. Also for forex trading reviews you can visit https://forex.best/rofx-review/.

What is Forex Trading?

Forex trading or currency trading is a global market where all the world’s currencies trade. It is the largest liquid market in the world with an average daily trading volume of $5 trillion. This volume will not be equaled by all the world’s combined stock markets. You may find some exciting trading opportunities if you take a closer look at forex trading. It is an electronic network of banks, brokers, institutions, and individual traders.

Many investors and financial institutions have currency needs and they interact with other currency orders from other parties by posting their orders to buy and sell currencies. Except for holidays, the forex market is open 24 hours a day for the entire week. You can even trade currencies on a holiday if the country/global market is open for business.

How to Trade in a Forex

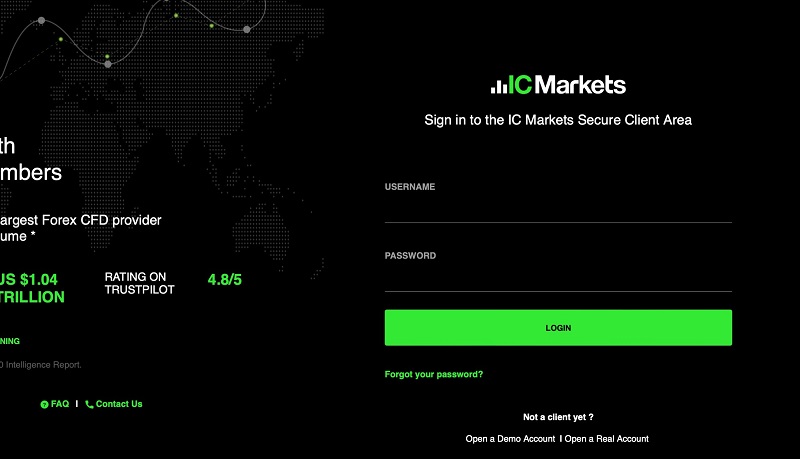

As the market is open 24/7 across major financial centers across the globe, you can buy and sell currencies at any time during the week. In the olden days, this trading was done only by governments, hedge funds, and large companies. But today, anyone can do forex trading because of easy accessibility. Individuals can open accounts in banks and investment firms and trade currencies. Two currencies are needed for forex trading because you will be betting on the value of a currency against other currencies.

Lets us take an example EUR/USD, the most-traded currency pair in the world. The first currency EUR is the base and second (USD) is the counter. When the price is quoted, you can see how much one euro is worth in US dollars. Two prices will be shown on the platform where one is the buy price and another is the selling price. Spread is the difference between these two prices. For example, consider the euro will increase in value against the US dollar. EUR/USD is your pair and when you think euro will go up, you buy EUR/USD. When you think euro will drop down against the US dollar, you can sell EUR/USD.

The banks will allow you to trade with leverage. You can set the margin based on the trade size. If you are new to forex trading, you should always start with small trade with leverage ratios until you are exposed to the market. Leverage does not increase profit but can increase your losses, which can exceed deposited funds.